For Fast and Reputable Info on Insolvency Discharge, Contact Us Today for Support

For Fast and Reputable Info on Insolvency Discharge, Contact Us Today for Support

Blog Article

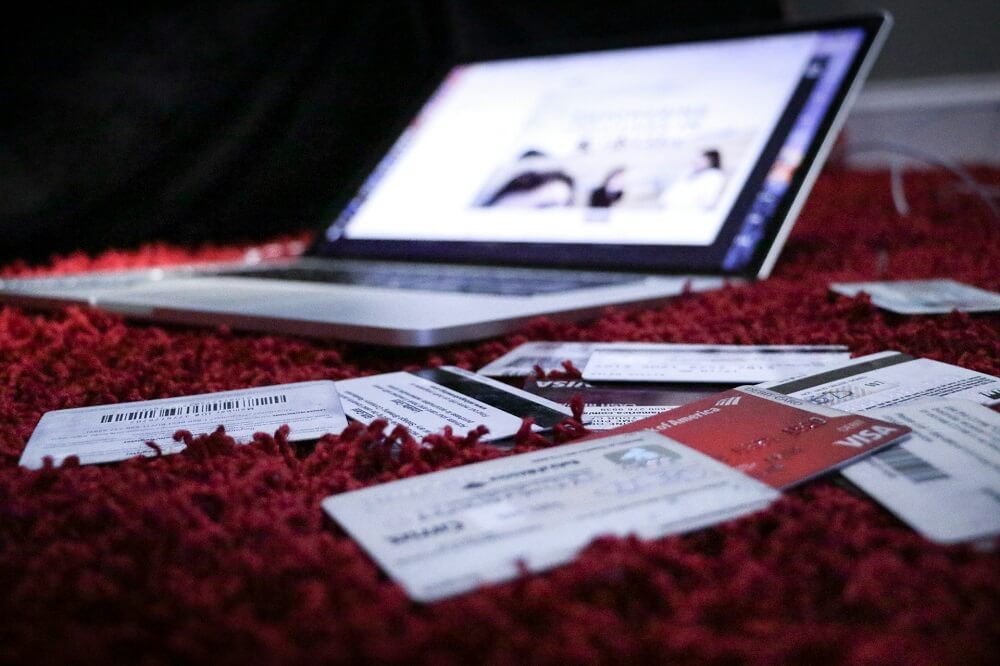

Charting the Course: Opportunities for Charge Card Access After Personal Bankruptcy Discharge

Browsing the globe of credit history card access post-bankruptcy discharge can be a complicated job for individuals looking to reconstruct their monetary standing. From protected credit rating cards as a stepping rock to possible courses leading to unsecured credit score chances, the trip towards re-establishing creditworthiness requires careful consideration and informed decision-making.

Understanding Credit Rating Essentials

A credit scores score is a mathematical depiction of a person's credit reliability, indicating to lenders the level of threat connected with extending credit. A number of factors add to the calculation of a debt score, consisting of payment background, amounts owed, length of debt background, brand-new credit score, and types of credit made use of. The amount owed loved one to readily available credit history, also recognized as credit scores application, is one more essential variable affecting credit ratings.

Secured Debt Cards Explained

Protected bank card give a valuable financial tool for individuals looking to reconstruct their credit rating complying with a personal bankruptcy discharge. These cards call for a down payment, which generally identifies the debt limitation. By utilizing a protected bank card sensibly, cardholders can show their creditworthiness to prospective lenders and slowly improve their credit report.

One of the vital advantages of protected charge card is that they are a lot more accessible to individuals with a restricted credit history or a damaged credit score (contact us today). Because the credit line is secured by a deposit, companies are a lot more happy to approve applicants that may not get approved for typical unsecured credit history cards

It is essential for individuals thinking about a protected bank card to pick a respectable provider that reports to the major credit score bureaus. This reporting is crucial for developing a favorable credit report and boosting credit history over time. Furthermore, liable use a secured credit scores card includes making prompt settlements and maintaining balances low to avoid collecting financial debt.

Credit History Card Options for Restoring

When looking for to rebuild debt after personal bankruptcy, exploring various credit report card options tailored to individuals in this monetary circumstance can be useful. Protected credit scores cards are a preferred option for those looking to reconstruct their credit report. An additional alternative is coming to be an accredited customer on a person browse around here else's credit card, enabling individuals to piggyback off their credit rating background and possibly enhance their very own score.

Just How to Receive Unsecured Cards

Monitoring credit history records consistently for any kind of mistakes and challenging errors can additionally enhance credit score ratings, making individuals extra eye-catching to credit score card companies. Additionally, people can take into consideration using for a protected credit scores card to rebuild credit. Guaranteed credit score cards need a money down payment as security, which decreases the threat for the company and permits individuals to show accountable credit history card usage.

Tips for Accountable Bank Card Usage

Building on the foundation of improved credit reliability developed via liable economic monitoring, people can boost their total economic health by applying vital pointers for liable credit card use. In addition, keeping a reduced credit utilization ratio, preferably listed below 30%, shows liable credit usage and can positively influence debt ratings. Abstaining from opening multiple new credit scores card accounts within a short period can prevent possible credit rating damages and extreme financial obligation build-up.

Final Thought

In conclusion, individuals who have applied for personal bankruptcy can still access bank card via various options such as secured bank card and restoring credit history. By recognizing credit report basics, getting unsecured cards, and exercising liable bank card use, people can Web Site progressively restore their credit reliability. It is crucial for people to meticulously consider their monetary circumstance and make educated choices to boost their debt standing after personal bankruptcy discharge.

A number of elements add to the estimation of a credit history score, consisting of settlement history, amounts owed, size of credit score background, new debt, and kinds of credit history used. The quantity owed family member to available debt, likewise known as debt use, is another critical element affecting credit report scores. Keeping an eye on credit scores records consistently for any type of mistakes and contesting errors can additionally boost credit score scores, making people extra appealing to credit rating card companies. Additionally, preserving a reduced credit scores use ratio, ideally listed below 30%, shows responsible credit score usage and can positively influence see page credit report scores.In verdict, people who have submitted for personal bankruptcy can still access credit report cards via various choices such as safeguarded credit scores cards and restoring credit rating.

Report this page